🚀 Our thesis

For too long, over a billion Muslims in emerging markets could not invest or get funding in line with their beliefs.1 They have been unbanked as they couldn’t access interest-free financial products. By not participating in the traditional debt-based financial ecosystem, Muslims end up subsidizing everyone else. Not only Muslims. Over two billion people worldwide cannot access basic financial products, whether it’s credit or deposits. Those that do see their savings inflated away.

At Umma, we believe that the traditional debt-based financial system is perverse, unjust, and socially destructive. Our mission is to democratize access to fair, transparent, and sustainable interest-free financial products for people across the globe. We are building a values-aligned community organized around the shared mission of building an interest-free network state. To make it happen, we use the power of: 1) Islamic finance principles; 2) stablecoins governed by smart contracts; and 3) bitcoin.

The “interest-free” status quo

Over 50 years ago, Islamic banks emerged with the goal to espouse the core principle of risk sharing and eliminating interest. The early pioneers of Islamic finance had noble ideas but they could never truly innovate nor connect with the values and culture of their target demographic. Instead of creating platforms for risk-sharing and equity-based financing, Islamic banks ended up repackaging traditional interest-based financial products, accompanied by sophisticated contracts and Shariah papers to justify it.

What once had been intended as a model for wealth distribution across society, for the empowerment of communities, financial inclusion, and a more sustainable economy, ended up being just another sophisticated tool for enriching the bankers and lawyers.2

🙌 Core beliefs

Real Islamic finance principles

The Islamic banking industry has not delivered the economic model it once promised, yet the core tenets of Islamic finance are much greater than that. Those principles are rooted in Islamic ethics but are not exclusive to Muslims. With its underlying principles of equitable distribution for all, more emphasis on productive investment, judicious spending of wealth, and the well-being of the community as a whole, Islamic finance presents an ethical alternative for non-Muslims. In reality, in the medieval ages, Christians and Jews also rejected the ideas of interest and usury.

“The standing of those who eat Riba is like standing of the one who is confounded by Devil’s stroke – that’s because they say trade is just like Riba, whereas Allah has permitted trade and forbidden Riba. Hence those who have received the admonition from their Lord and desist, may keep their previous gains, their case being entrusted to Allah; but those who revert shall be the inhabitants of the fire and abide therein forever” (Al-Quran 2/275)

“If you lend money to any of my people with you who is poor, you shall not be like a moneylender to him, and you shall not exact interest from him.” (Exodus 22:25)

“takes advance or accrued interest; shall he then live? He shall not. He has done all these abominable things; he shall surely die; his blood shall be upon himself.” (Ezekiel 18:13)

With the advent of modern economic systems, however, both Christianity and Judaism have struggled to maintain these morally-defined positions, even within their own faith communities.

It’s time to rethink how we bring real Islamic finance principles to the world and make the financial system cheaper, faster, more innovative, and more inclusive. With just ~1% penetration of the world’s assets but ~25% of its population, the growth potential for Islamic finance is tremendous, especially in emerging markets.

Stablecoins as a lifeline for individuals in emerging markets

For the mission of bringing Islamic finance to the world, stablecoins governed by smart contracts are uniquely positioned.

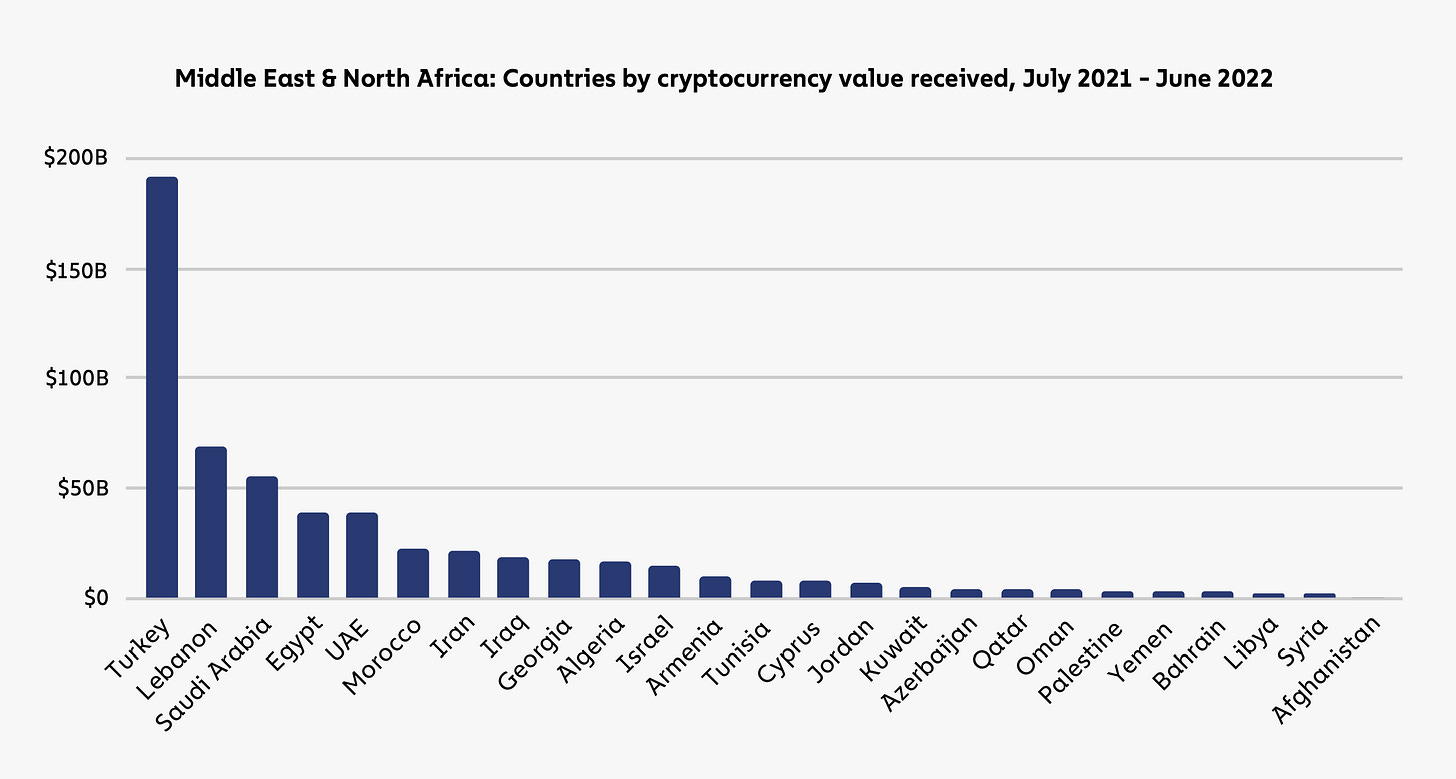

For most people in developed markets, stablecoins are merely a convenient payment tool. For individuals in emerging markets, USD-denominated stablecoins are a shield and means for survival. Unsurprisingly, the countries experiencing more stablecoin adoption are countries with more unstable currencies, such as Turkey and Lebanon.

Beyond stablecoins, smart contracts deliver a step change in the way we can collectively pool capital to make real Islamic finance possible:

We can disintermediate, automate, and facilitate novel financial products and reward systems

Open-source software and composability enable global coordination, collaboration, and innovation, with transparency and accountability

We can now truly own sovereign assets, entities, and identities, with a level of security never seen before

We can create fully decentralized organizations, which are truly autonomous and unstoppable, with transparent governance, and even create new decentralized countries

For Islamic finance, smart contracts add further transparency to Sharia compliance in addition to reducing costs and making transaction structuring more efficient

By bringing stablecoin liquidity to emerging markets, we can enable opportunities for sustainable high-yield (yet interest-free) investment opportunities for investors worldwide while easing access to financing for businesses and individuals in the most underserved markets. For the first time ever, everyone will be able to access an incredibly safe, diversified, reliable Sharia-compliant yield for stablecoins, uncorrelated to crypto.

Eventually, we believe that all global economic activity will move on-chain, making every transaction programmable. We want to be at the forefront of that shift and be the platform that will bring $3 trillion of halal finance liquidity on-chain.

Risk-sharing financial institutions on a sound money standard

We are aware that as long as the financial system is still based on interest-based fractional reserve banking, adopting Islamic finance & DeFi can only go so far in eliminating interest. At the end of the day, it doesn't really matter how shariah-compliant the product is if in the framework underneath the money is created out of money, which is the definition of interest.

“Fiat is a tax on being Muslim. Because if you are using money that is devalued, everybody who engages in lending and borrowing is benefitting from the devaluation of the currency and everybody who saves is paying for that.

So effectively, it’s taxing people who don’t engage in interest-based lending and rewarding people who do. And I think this has been a massive problem for the Islamic world over the last 100 years. Because they haven’t been able to benefit from the system as much as others have.” - Saifedean Ammous

However, we believe that long-term visions are only achieved by winning short-term battles that push Islamic finance forward.

But how would you construct a modern economy without interest?

The only alternative to interest-based banking that showed some traction in the Muslim world was the Gold Dinar Movement. However, the logistic and regulatory hindrances of moving physical gold coins across national boundaries have stalled the movement's adoption.

That’s where bitcoin comes in. Both gold and bitcoin are inflation-proof, decentralized, divisible, scarce, and finite. Bitcoin has several additional qualities that gold doesn’t have, such as absolute scarcity, utility as a currency (particularly through its second layer), pseudo-anonymity, speed of transfer, more resistance to theft, open source, and programmability.

A monetary system underpinned by bitcoin clearly aligns with the core tenets of Islamic finance.

Most importantly, bitcoin enables the provision of trust through the technology protocol without relying on any centralized entity. This has massive implications across many areas: in finance, business, governance, and society. It not only makes an interest-free financial system possible but also enables applications built on top of bitcoin.

But Islamic finance, bitcoin, smart contracts, or DeFi are only a means to an end. Same for cryptography, distributed systems, open-source software, and any other tool. So, what’s the end goal?

We need to change the way finance is done and societies are governed. We need an interest-free nation: an opt-in value-based society, where everyone has chosen to be there and can leave anytime.

🌍 Our roadmap

Reforming the existing financial system is very difficult. Creating a new financial system seems even harder. Many people think that it’s impossible. But for those that believe in the mission, like us, there is a moral imperative to contribute towards building a value-based financial system based on shared faith and belief in interest-free money.

How do we achieve that?

In phase 0, we have built an Islamic neobank that allows people to get funding or invest in line with their beliefs. Over 20,000 investors have invested through our platform and generated ~30% annualized returns by funding 20,000 people’s interest free purchases. We will be adding new financial products and services in both fiat and crypto with the goal to build a one-stop shop for Islamic finance.

In phase 1, we create a global digital community. We recruit online for a group of people interested in building an interest-free society. We are issuing free NFT passports for those who wish to support, participate in and contribute to the interest-free network state. Umma NFTs will grant our citizens a digital passport, alongside early access to our products, events, and future value-added services.

In phase 2, we launch Umma.Finance, an interest-free decentralized finance protocol governed by our citizens. You will be able to grow your wealth in a sustainable interest-free manner by financing real-world businesses in emerging markets where capital is so much more needed. Eventually, through Umma, everyone from smallholder farmers in Pakistan to the largest institutions in UAE will be able to get funding or invest in line with their values.

In phase 3, we build an offline community where members can build trust among themselves. At that stage, we will have an internal economy based on bitcoin or another digital currency chosen by the citizens. We can then crowdfund physical territories, such as apartments, houses, and cities in different parts of the world to enable our citizens to connect with the physical world.

In phase 4, the final phase, we might seek diplomatic recognition of its sovereignty from legacy states to become a true Network State. Or maybe not. It’s up to the community.

Image - “The Network State in One Image”.

The power to change the world, to avoid interest, to move to sound money is truly in our hands. We don’t have to embrace the debt economy to accomplish our life goals and create a better future for the next generation. If we stick to our principles and create products with authenticity, then we change the world.

📖 Our values

We envision an interest-free network state where anyone can invest or get funding in line with beliefs;

We believe in a future where you don’t have to invest your savings in risky assets in order to protect yourself from inflation;

We believe in adopting Islamic finance principles that promote risk-sharing, more reliance on real assets, and more sustainable investments;

We create value on a foundation of day-to-day productive economic activities, like financing small and medium businesses in emerging markets. Not by crypto speculation or financial engineering;

We build free open-source technology for the purpose-driven community, with the purpose-driven community. Everything we build is a public good, and we empower anyone to contribute. We provide opportunities for all who are willing to demonstrate value. We reward contribution;

We are committed to decentralizing power over time in order to dismantle unjustified power that springs from centralization;

We don't take shortcuts. We build for long-term value creation, not for short-term profit - which in turn, advances the project’s sustainability. In order to make a lasting impact and disrupt existing power structures, we must create long-term incentives that provide sustainable economic value to all participants;

We cannot go at it alone. We design for composability and work alongside other projects that pledge to support our values and build the underlying infrastructure needed for an interest-free society to flourish. We build primitives so other projects can assemble these modular building blocks around their own values and needs. We know by collaborating we can make a better future beyond all skepticism;

We strive for transparency in our objectives and operations. We advocate for governance where the outcome of participation has a provable result. We put all of our activities on-chain, giving governance as much hardness, security, and impact as possible;

We foster pluralism. We avoid becoming too attached to our ideas by encouraging diversity of thought. This makes us resilient and stronger together;

We believe in the core tenets of Islamic finance and we will not compromise our values. We will not repackage traditional financial instruments and make them ‘sharia compliant”;

We consider this Manifesto an alpha and look forward to the community's feedback to evolve it over time to a definitive version.

Join us in this fight for an interest-free world!

Islamic Finance refers to the provision of financial services in accordance with Shari'ah Islamic law, principles and rules. Shari'ah does not permit receipt and payment of "riba" (interest), "gharar" (excessive uncertainty), "maysir" (gambling), short sales or financing activities that it considers harmful to society. Instead, the parties must share the risks and rewards of a business transaction and the transaction should have a real economic purpose without undue speculation, and not involve any exploitation of either party

See Safdar Alam’s twitter thread and WSJ article to better understand how largest Islamic banks ended up repackaging traditional interest-based financial products

Hello, I like what i am seeing. Umma has some real potential.

Mark, is it planned to have an incorporated company (with physical presence) for umma.finance, or will it always be a decentralized protocol only?

If it is the first, then the Free Private Cities in Honduras (called ZEDE there) could be your way to go. What do you think?